THE KRAFT HEINZ COMPANY

ONE PPG PLACE

PITTSBURGH, PENNSYLVANIA 15222

March 3, 2016

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| The Kraft Heinz Company | |

| 200 East Randolph Street | |

| Suite 7600 | |

| Chicago, Illinois 60601 | |

| March 3, 2017 | |

THE KRAFT HEINZ COMPANY

ONE PPG PLACE

PITTSBURGH, PENNSYLVANIA 15222

March 3, 2016

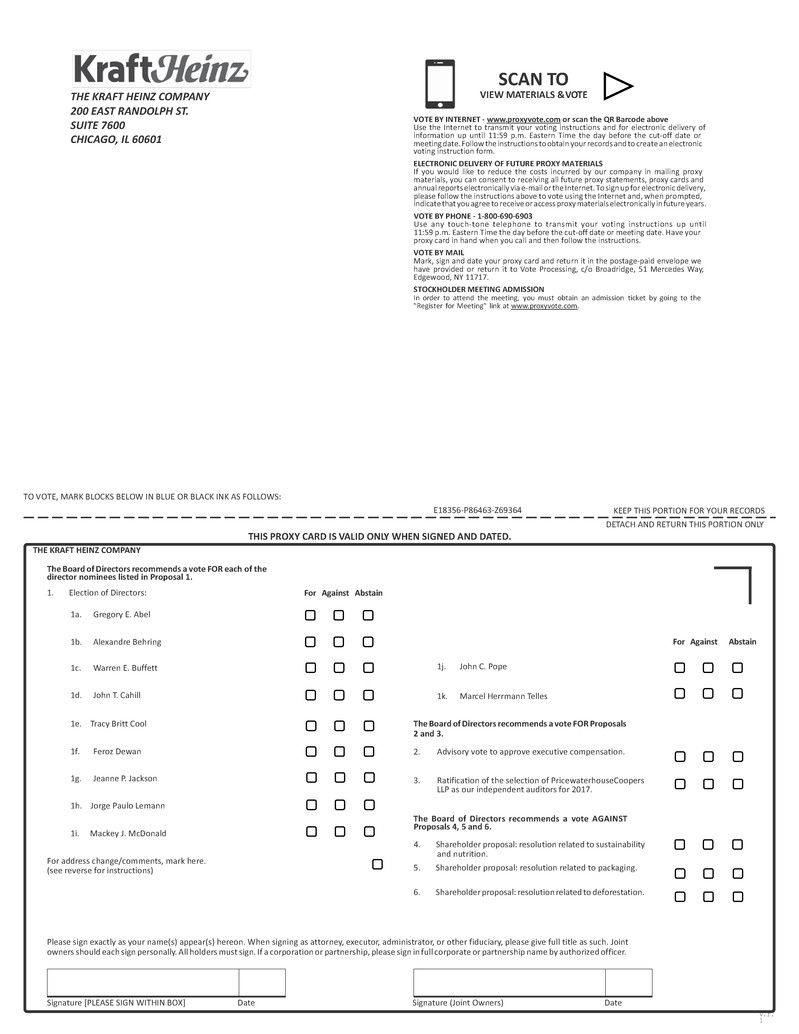

To elect all director nominees named in the Proxy Statement to one-year terms expiring in To hold an advisory vote to approve executive compensation; To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for To vote on three shareholder proposals, if properly presented; and 19, 2017 Time and Date Place Record Date Voting Admission Proposal Proposal 1 – Proposal 2 – Proposal 3 – Name Age Director Occupation and Experience Independent Audit Comp Gov Ops & Gregory E. Abel Alexandre Behring (Chairman) Warren E. Buffett John T. Cahill Tracy Britt Cool Jeanne P. Jackson Jorge Paulo Lemann Mackey J. McDonald John C. Pope Marcel Herrmann Telles Place a significant portion of compensation at risk if performance goals are not achieved; Align the interests of the Named Executive Officers with those of our stockholders; and Enable us to attract, retain and motivate top talent. Messrs. Abel and Buffett and Ms. Cool (each of whom was selected by Berkshire Hathaway); and Messrs. Cahill, Director Alexandre Behring (Chairman) John T. Cahill (Vice Chairman) Gregory E. Abel Tracy Britt Cool Jeanne P. Jackson Jorge Paulo Lemann Mackey J. McDonald John C. Pope Marcel Herrmann Telles director nominee as of February 54 nuclear power facilities. skills, including international experience. 50 86 (Vice Chairman) 59 corporate governance. 65 77 70 67 the Board of Waste Management, Inc., a provider of comprehensive waste management services. Mr. Pope also served as Chairman of the Board of MotivePower Industries, Inc., a manufacturer and remanufacturer of locomotives and locomotive components, from December 1995 to November 1999. Prior to joining MotivePower Industries, Inc., Mr. Pope served in various capacities at United Airlines, a U.S.-based airline, and its parent, UAL Corporation, including as Director, Vice Chairman, President, Chief Operating Officer, Chief Financial Officer and Executive Vice President, Marketing and Finance. Mr. Pope is Chairman of the Board of R.R. Donnelley and Sons Co. and a director of Talgo S.A. and Waste Management, Inc. Mr. Pope was formerly a director of Con-way, Inc., Dollar Thrifty Automotive Group, Inc., Kraft, Mondelēz International and Navistar International Corporation. 66 The Audit Committee and the Board of Directors believe that the continued retention of PwC to serve as the Company’s independent auditors for 2017 is in the best interests of the Kraft Heinz and its stockholders. The Audit Committee and the Board are not required to take any action as a result of the outcome of the vote on this proposal. However, if our stockholders do not ratify the selection, the Audit Committee may investigate the reasons for our stockholders’ rejection and may consider whether to retain PwC or appoint another independent auditor. Furthermore, even if the selection is ratified, the Audit Committee may appoint a different independent auditor if, in its discretion, it determines that such a change would be in Kraft Heinz’s and our stockholders’ best interests. honest and ethical conduct; due care, diligence and loyalty; confidentiality of our proprietary information; compliance with applicable laws, rules and regulations, including insider trading compliance; and accountability for adherence to the Directors Ethics Code and prompt internal reporting of violations. the commercial reasonableness of the transaction; the materiality of the related person’s direct or indirect interest in the transaction; whether the transaction may involve an actual, or the appearance of a, conflict of interest; the impact of the transaction on the related person’s independence (as defined in the Guidelines and the NASDAQ listing standards); and whether the transaction would violate any provision of our Directors Ethics Code or Code of Conduct. certain directors that are designated by either 3G Global Food Holdings or Berkshire Hathaway. Pursuant to the shareholders’ agreement, 3G Global Food Holdings requirements. person Alexandre Behring (Chairman) John T. Cahill (Vice Chairman) Gregory E. Abel Warren E. Buffett Tracy Britt Cool L. Kevin Cox* Jeanne P. Jackson Jorge Paulo Lemann Mackey J. McDonald John C. Pope Marcel Herrmann Telles Meetings in 2015 2016. the integrity of our financial statements, our accounting and financial reporting processes and our systems of internal control over financial reporting and safeguarding of our assets; our compliance with legal and regulatory requirements; our independent auditors’ retention, termination, qualifications, independence and performance; the performance of our internal auditors and internal audit function; our financial matters and financial strategy; and our guidelines and policies that govern the process by which we assess and manage risk. partner and considers regular rotation of the lead partner(s) as required by law or otherwise appropriate. The information contained in the above report will not be deemed to be “soliciting material” or “filed” with the SEC, nor will this information be incorporated by reference into any future filing under the Securities Act of 1933, or the Exchange Act, except to the extent that Kraft Heinz specifically incorporates it by reference in such filing. requires management to report at Audit Committee meetings throughout the year on the actual fees charged by the independent auditors for each category of service. The Audit Committee reviews this policy annually. Audit Fees Audit-Related Fees Tax Fees All Other Fees Total “Audit-Related Fees” include professional services in connection with accounting consultations and procedures related to various other audit and special reports. “Tax Fees” include professional services in connection with tax compliance and advice. “All Other Fees” consist principally of software license fees related to research and benchmarking. All fees above include out-of-pocket expenses. identifying qualified individuals for Board membership consistent with Board approved criteria; considering incumbent directors’ performance and suitability in determining whether to recommend that our Board nominate them for re-election; making recommendations to our Board as to directors’ independence and related person transactions; recommending to our Board the appropriate size, function, needs, structure and composition of our Board and its committees; recommending to our Board directors to serve as members of each committee and candidates to fill committee vacancies; developing and recommending to our Board and overseeing an annual self-evaluation process for our Board; administering and reviewing the Directors Ethics Code; and advising our Board on corporate governance matters, including developing and recommending to our Board corporate governance guidelines. establishing, reviewing, approving and administering our compensation and benefits policies generally (subject, if required by applicable law, stock exchange requirements or our charter documents, to stockholder approval), including establishing, reviewing and making recommendations with respect to any incentive-compensation and equity-based plans of the Company that are subject to Board approval; reviewing and approving our Chief Executive Officer’s goals and objectives, evaluating his performance in light of these goals and objectives and, based upon this evaluation, determining both the elements and amounts of his compensation; reviewing management’s recommendations for, and determining and approving the compensation of, our executive officers and other officers subject to Section 16(a) of the Exchange Act; determining annual incentive compensation, equity awards and other long-term incentive awards granted under our equity and long-term incentive plans to eligible participants; reviewing our compensation policies and practices for employees as they relate to our risk management practices and risk-taking incentives; assessing the appropriateness of, and advising our Board regarding, the compensation of non-employee directors for service on our Board and its committees; monitoring compliance with stock ownership guidelines; reviewing and approving the implementation and execution of clawback policies that allow Kraft Heinz to recoup compensation paid to executive officers and other employees. Achieve a balance of short and long-term performance aligned with key stakeholder interests; Discourage executives from taking unnecessary or excessive risks that would threaten the reputation and/or sustainability of Kraft Heinz; and Encourage appropriate assumption of risk to the extent necessary for competitive advantage purposes.One PPG PlacePittsburgh, Pennsylvania 1522220162017 ANNUAL MEETING OF STOCKHOLDERSTIME AND DATE: 11:00 a.m. EDT on Thursday,Wednesday, April 21, 2016.19, 2017.PLACE: Offices of Reed Smith LLP 225 Fifth Ave., Pittsburgh, PA 15222 225 Fifth Ave.,Pittsburgh, PA 15222ITEMS OF BUSINESS: (1) 2017; (2) (3) To hold an advisory vote on the frequency of an executive compensation vote;(4)To approve The Kraft Heinz Company 2016 Omnibus Incentive Plan;(5)2016; and (6)(4)(5) To transact any other business properly presented at the meeting. WHO MAY VOTE: Stockholders of record at the close of business on February 22, 2016.21, 2017.WHO MAY ATTEND: If you would like to attend the Annual Meeting, you must be a stockholder on the record date and obtain an admission ticket in advance. For details on attending the Annual Meeting, see Question 19 on page 5344 of the Proxy Statement.DATE OF DISTRIBUTION: We mailed our Notice of Internet Availability of Proxy Materials on or about March 3, 2016.2017. For stockholders who previously elected to receive a paper copy of the proxy materials, we mailed the Proxy Statement, our Annual Report on Form 10-K for the year ended January 3,December 31, 2016 and the proxy card on or about March 3, 2016.2017.March 3, 2017

March 3, 2016 21, 2016 Page Page 1 3 3 10 10PROPOSAL 4. APPROVAL OF THE KRAFT HEINZ COMPANY 2016 OMNIBUS INCENTIVE PLAN11PROPOSAL 5. RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS 18 19 19 19 20 20 23 24 24 24 25 25 25 28 29 31 32 33 35 41 41 42 43 44 44 44 45 47 49 49 54 A-1 i 11:00 a.m. EDT on Tuesday,Wednesday, April 21, 201619, 2017 Offices of Reed Smith LLP, 225 Fifth Ave., Pittsburgh, PA 15222 February 22, 201621, 2017 Stockholders as of the Record Date are entitled to one vote per share on each matter to be voted upon at the 20162017 Annual Meeting of Stockholders (the “Annual Meeting”). If you plan to attend the meeting, you must be a stockholder of record on the Record Date and obtain an admission ticket in advance as described in Question 19 on page 5344 of this Proxy Statement. As space is limited, it is mandatory that you obtain a ticket in advance. BoardRecommendationPageReferenceElection of Directors For all nominees 3 Advisory Vote to Approve Executive Compensation For 109Advisory Vote on the Frequency of an Executive Compensation VoteFor “1 Year”10Proposal 4 –Approval of The Kraft Heinz Company 2016 Omnibus Incentive PlanFor11Proposal 5 –Ratification of the Selection of PricewaterhouseCoopers LLP as Independent Auditors for 20162017 For 189Proposal 4 – Shareholder Proposal: Resolution Related to Sustainability and Nutrition Against 21 Proposal 5 – Shareholder Proposal: Resolution Related to Packaging Against 22 Proposal 6 – Shareholder Proposal: Resolution Related to Deforestation Against 23 22, 2016.

Since

Strat 53 2013 Chairman, Chief Executive Officer and President, Berkshire Hathaway Energy Yes X 49 2013 Founding Partner, Managing Partner and Board Member, 3G Capital Yes Chair Chair X 85 2013 Chairman and Chief Executive Officer, Berkshire Hathaway Inc. Yes

(Vice Chairman) 58 2015 Former Chairman and Chief Executive Officer, Kraft Foods Group, Inc. No Chair 31 2013 Chief Executive Officer, The Pampered Chef Yes 64 2015 President, Product and Merchandising, NIKE, Inc. Yes X X 76 2013 Founding Partner and Board Member, 3G Capital Yes X X 69 2015 Senior Advisor, Crestview Partners Yes X X 66 2015 Chairman, PFI Group, LLC Yes Chair X 65 2013 Founding Partner and Board Member, 3G Capital Yes X X Name Age Occupation and Experience Independent Audit Comp Gov Gregory E. Abel 54 2013 Chairman, Chief Executive Officer and President, Berkshire Hathaway Energy Yes X Alexandre Behring (Chairman) 50 2013 Founding Partner, Managing Partner and Board Member, 3G Capital Yes Chair Chair X Tracy Britt Cool 32 2013 Chief Executive Officer, The Pampered Chef Yes Warren E. Buffett 86 2013 Chairman and Chief Executive Officer, Berkshire Hathaway Inc. Yes John T. Cahill (Vice Chairman) 59 2015 Former Chairman and Chief Executive Officer, Kraft Foods Group, Inc. No Chair Feroz Dewan 40 2016 Chief Executive Officer, Arena Holdings Management Yes X Jeanne P. Jackson 65 2015 President and Strategic Advisor, NIKE, Inc. Yes X X Jorge Paulo Lemann 77 2013 Founding Partner and Board Member, 3G Capital Yes X X Mackey J. McDonald 70 2015 Senior Advisor, Crestview Partners Yes X X John C. Pope 67 2015 Chairman, PFI Group, LLC Yes Chair X Marcel Herrmann Telles 66 2013 Founding Partner and Board Member, 3G Capital Yes X X 35)28). This “say-on-pay” vote is not intended to address any specific item of our compensation program, but rather to address our overall approach to the compensation of our Named Executive Officers as described in this Proxy Statement.beginning on page 35 and related “Executive Compensation Tables” beginning on page 41 for additional details about our executive compensation programs, including information about our Named Executive Officers’ fiscal year 20152016 compensation.FREQUENCY OF VOTES ON EXECUTIVE COMPENSATIONSection 14A of the Exchange Act and related SEC rules also enable our stockholders to indicate how frequently they want to vote on the compensation of our Named Executive Officers. We ask that our stockholders cast an advisory (non-binding) vote on how frequently we should have such votes in the future. Our Board recommends that stockholders vote to annually approve, on an advisory basis, the compensation of our Named Executive Officers.APPROVAL OF THE KRAFT HEINZ COMPANY 2016 OMNIBUS INCENTIVE PLANasking our stockholders to approve The Kraft Heinz Company 2016 Omnibus Incentive Plan, which was adopted by our Board in February 2016 and we believe furthers our pay-for-performance philosophy and executive compensation goals described above.AUDITORSAs a matter of good governance, we arealso asking our stockholders to ratify the selection of PricewaterhouseCoopers LLP (“PwC”) as our independent auditors for the fiscal year ending January 1,December 30, 2017., and together with its affiliates, “3G Capital”) following their acquisition of H.J. Heinz Company on June 7, 2013. On July 2, 2015, through a series of transactions, we consummated the merger of Kraft Foods Group, Inc. (“Kraft”) with and into a wholly owned subsidiary of H.J. Heinz Holding Corporation (“Heinz”) (the “2015 Merger”). At the closing of the 2015 Merger, Heinz was renamed The Kraft Heinz Company and all outstanding shares of Kraft common stock (other than deferred shares and restricted shares) were converted into the right to receive, on a one-for-one basis, shares of Kraft Heinz common stock.Company. Following the 2015 Merger, we became a public company listed on The NASDAQ Global Select Market (“NASDAQ”). Berkshire Hathaway and 3G Capital continue to hold a majority of our outstanding shares. See “Ownership of Equity Securities” for further information about their respective stock ownership.as follows:including the following Director nominees: Cox, McDonald and Pope and Ms. Jackson (each of whom was selected by Kraft).The parties to the 2015 Merger also agreed that Mr. Behring would serve as Chairman and Mr. Cahill as Vice Chairman of the Board of Directors.theirits affiliates will vote the shares of Kraft Heinz common stock held by them with respect to supporting certain directors who are nominated by the Board and designated for support by either 3G Global Food Holdings or Berkshire Hathaway. See “Certain“Corporate Governance and Board Matters — Independence and Related Person Transactions — Certain Relationships and Transactions with Related Persons —Shareholders’ Agreement” for further information.Theourthe Board effective October 21, 2016 to fill a vacancy created in connection with the retirement of DirectorsL. Kevin Cox on April 21, 2016.February 2016,January 2017, the Governance Committee recommended and the Board nominated each director for re-election to the Board of Directors.On February 11, 2016, Kevin Cox informed us that he will not stand for re-election due to other commitments and will step down from the Board at the time of the Annual Meeting. As of the date ofthis Proxy Statement, the Governance Committee is identifying and evaluating potential candidates to fill the vacancy created by Mr. Cox’s decision to not stand for re-election. Upon completion of the evaluation and nomination process described above, the Governance Committee expects to recommend a candidate to the full Board for consideration to fill this vacancy.•significant operating experience as current or former executives, which provides directors with specific insight into, and expertise that will foster active participation in, the development and implementation of our operating plan and business strategy;•consumer products and retail industry knowledge, which is vital in understanding and reviewing our strategy;•leadership experience, as directors who have served in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others;•accounting and financial expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting and financial reporting processes;•product development and marketing experience in complementary industries, which contributes to our identification and development of food and beverage products and implementation of marketing strategies that will improve our performance; and•public company board and corporate governance experience at large, publicly traded global companies, which provides directors with a solid understanding of their extensive and complex oversight responsibilities and furthers our goals of greater transparency, accountability for management and the Board and protection of stockholder interests. Operating Industry Leadership Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü ü ü ü ü ü Warren E. Buffett Öü Öü Öü Öü ÖüTracy Britt Cool Öü Ö Öü ü Ö ü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü Öü20172018 Annual Meeting of Stockholders or until his or her successor has been duly elected and qualified. The following presents information regarding each22, 2016,18, 2017, including information about the director’s professional experience, public company directorships held and qualifications.53an electrica diversified global holding company that owns subsidiaries principally engaged in energy businesses in the Unites States, Canada, Great Britain and natural gas service provider with more than 11.5 million customers worldwide.the Philippines. The Berkshire Hathaway Energy energy-related businesses include AltaLink, L.P., BHE Pipeline Group, BHE Renewables, BHE U.S. Transmission, HomeServices of America, Inc., MidAmerican Energy Company, Northern Powergrid Holdings Company, NV Energy, Inc. and PacifiCorp. Mr. Abel serves as Chairman, and Chief Executive Officer and Director of PacifiCorp;PacifiCorp, as Chairman, President, Chief Executive Officer and Director of CE Casecnan Ltd., as Chairman and Director of Northern Natural Gas Company, Northern Powergrid Holdings Company and NV Energy, Inc., and as Director of AltaLink Management Ltd. and HomeServices of America, Inc. currently serves on the board and executive committee of the Edison Electric Institute. He also serves as a director on theDirector and Vice Chairman of Edison Electric Institute, an association of U.S. investor-owned electric companies and AEGIS Insurance Services, Inc., a mutual insurance company, and serves on the Board of Directors for Kum & Go, L.C., a convenience store chain, and Nuclear Electric Insurance Limited, boarda mutual insurance company of directors. a chief executive officer and director of multiple energy companies. Due to his service as a director in a highly-regulated industry and his management experience, he provides the Board with strong regulatory and operational skills.492014,2014. Previously, he had served on the Board of Directors of Burger King Worldwide, Inc. and its predecessor as chairman from October 2010 until December 2014. He has also served as a director of Anheuser-Busch Inbev, a global brewer, since April 2014.854345 years of experience as Chairman and Chief Executive Officer of publicly traded and private companies, providing the Board with a strong background in finance, investing and other complex subjects. His extensive experience in investing and building companies provides the Board with strong leadership and an investor’s perspective. Mr. Buffett has significant investment experience, including the evaluation of strategic opportunities and challenges of Kraft Heinz’s business and our competitive and financial position, as well as experience in public and private company financial reporting practices.58Tracy Britt Cool31Ms. Cool40June 2013. Ms. CoolOctober 2016. Mr. Dewan is CEO of Arena Holdings Management LLC, an investment holding company. Previously, Mr. Dewan has served in several positions with Tiger Global Management, an investment firm with approximately $20 billion under management across public and private equity funds, from 2003 to 2015, including most recently as Head of Public Equities. He also served as a Private Equity Associate at Silver Lake Partners, a private equity firm focused on leveraged buyout and growth capital investments in technology, technology-enabled and related industries, from 2002 to 2003. Mr. Dewan has served as Chief Executive Officera director of The Pampered Chef,Fortive Corporation, a direct seller of high-quality cooking tools,diversified industrial growth company, since November 2014. Ms. Cool joined Berkshire Hathaway, The Pampered Chef’s parent company, in December 2009 as Financial Assistant to the Chairman. Ms. Cool is currently the Chairman of Benjamin Moore & Co., a leading manufacturer and retailer of paints and architectural coatings (since June 2012), Chairman of Larson-Juhl, a manufacturer and distributor of wood and metal framing products (since January 2012), Chairman of Oriental Trading Company, a direct merchant of party suppliers, arts and crafts, toys and novelties (since November 2012), and Chairman of Johns Manville, a manufacturer of commercial and industrial roofing systems, fire-protection systems, thermal and acoustical insulation, glass textile wall coverings and flooring (since November 2012).Ms. CoolJuly 2016.as chairman of several Berkshire Hathaway subsidiaries,with technology and technology related companies as well as insight intoexperience in the areas of financial investmentmatters, risk management and other complex subjects.64Product and MerchandisingStrategic Advisor, of NIKE, Inc., a designer, marketer and distributor of athletic footwear, equipment and accessories, since July 1, 2013.June 2016. She previously served as NIKE's President, Product and Merchandising from July 2013 until June 2016 and President, Direct to Consumer at NIKE, Inc. from 2009 until July 2013. Prior to that, she founded and served as the Chief Executive Officer of MSP Capital, a private investment company, from 2002 to 2009 and as Chief Executive Officer of Walmart.com, a private eCommerce enterprise, from 2000 to 2002. Ms. Jackson currently serves as a director of Delta Airlines, Inc. and McDonald’s Corporation and was formerly a director of Kraft and Motorola Mobility Holdings, Inc. Ms. Jackson previously served in various leadership positions at Gap Inc., Victoria’s Secret, Saks Fifth Avenue and Federated Department Stores, Inc., all clothing retailers, and Walt Disney Attractions, Inc., the theme parks and vacation resorts division of The Walt Disney Company, a mass media company.766966marketinginternational experience.653528 and “Executive Compensation Tables” beginning on page 4133 for specific details about our executive compensation programs. Your vote is not intended to address any specific item of our compensation program, but rather to address our overall approach to the compensation of our Named Executive Officers described in this Proxy Statement. This vote on the Named Executive Officer compensation is advisory, and therefore will not be binding on Kraft Heinz, our Compensation Committee or our Board. However, our Board and Compensation Committee value our stockholders’ opinions and will evaluate the results of this vote. ADVISORY VOTE ON THE FREQUENCY OF AN EXECUTIVE COMPENSATION VOTEIn accordance with Section 14A of the Exchange Act and related SEC rules, we are asking our stockholders to indicate how frequently they want to vote on the compensation of our named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules, such as Proposal 2 in this Proxy Statement. By voting on this Proposal 3, stockholders may indicate whether they would prefer an advisory vote on named executive officer compensation once every one, two or three years. This non-binding “frequency” vote is required at least once every six years beginning with this Annual Meeting.After careful consideration of this proposal, our Board determined that an annual advisory vote on named executive officer compensation is the most appropriate alternative for Kraft Heinz and recommends that you vote for a one-year interval for the advisory vote on named executive officer compensation.The Board believes that stockholders should vote on named executive officer compensation every year so that they may annually provide us with their direct input. Setting a one-year period for holding this stockholder vote will enhance stockholder communication by providing a clear, simple means for Kraft Heinz to obtain information on investor sentiment about our executive compensation philosophy, policies and practices. In addition, an annual advisory vote on executive compensation is consistent with our policy of seeking input from, and engaging in discussions with, our stockholders on corporate governance matters and our executive compensation program. We understand that our stockholders may have different views as to the best approach for Kraft Heinz, and we look forward to hearing from our stockholders on this proposal.In voting on this proposal, you should be aware that you are not voting “for” or “against” the Board’s recommendation to vote for a frequency of one year for holding future advisory votes on named executive officer compensation. Rather, you are voting on your preferred voting frequency bychoosing the option of one year, two years or three years or you may abstain from voting on this proposal. Because this vote is advisory and not binding, our Board and Compensation Committee may decide that it is in the best interests of our stockholders and Kraft Heinz to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.The Board recommends a vote for a 1 YEAR interval for the advisory vote on named executive officer compensation.PROPOSAL 4. APPROVAL OF THE KRAFT HEINZ COMPANY 2016 OMNIBUS INCENTIVE PLANAttracting, retaining, rewarding and motivating our employees, directors, officers, consultants and other service providers who are expected to contribute significantly to the success of Kraft Heinz and incentivizing such individuals to perform at the highest level is critical to achieving our strategic and operating goals, including our goal to increase stockholder value. Cash and equity-based awards, including performance-based awards, are key components of our compensation package. We believe that the ability to grant these types of awards allows us to remain competitive in the marketplace and enables us to link executive compensation to performance, and to attract, retain and motivate high-caliber talent dedicated to our long-term growth and success.We are asking stockholders to approve The Kraft Heinz Company 2016 Omnibus Incentive Plan (the “2016 Omnibus Plan”). On February 2, 2016, our Board unanimously approved and adopted the 2016 Omnibus Plan. The effective date of the 2016 Omnibus Plan is February 2, 2016, and the plan will expire on the tenth anniversary of the effective date. The approval and adoption of the 2016 Omnibus Plan is subject to approval and ratification by Kraft Heinz stockholders at the Annual Meeting.We are seeking stockholder approval and ratification of the 2016 Omnibus Plan in order to (i) comply with NASDAQ rules requiring stockholder approval of equity compensation plans, (ii) satisfy the stockholder approval requirement under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) and the rules and regulations thereunder (collectively, “Section 162(m)”) so that the Compensation Committee of the Board (the “Committee”) may grant awards that are intended to meet the requirements of the performance-based compensation exception under Section 162(m) and (iii) allow us to continue to utilize cash and equity-based awards, including performance-based awards, to attract, retain and motivate employees and to further align the interests of our employees with those of our stockholders.Summary of the 2016 Omnibus PlanThe following is a summary of the 2016 Omnibus Plan. This summary is qualified in its entirety by reference to the full text of the 2016 Omnibus Plan, which is attached asAppendix A to this Proxy Statement.The purpose of the 2016 Omnibus PlanThe purpose of the 2016 Omnibus Plan is to attract, retain and reward those employees, directors and other individuals who are expected to contribute significantly to our success, to incentivize such individuals to perform at the highest level, to strengthen the mutuality of interests between such individuals and our stockholders and, in general, to further the best interests of Kraft Heinz and our stockholders.Types of awardsThe 2016 Omnibus Plan provides for the grant of options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), deferred stock, performance awards, investment rights, other stock-based awards and cash-based awards.Plan administrationThe 2016 Omnibus Plan is administered by the Committee or such other committee the Board designates to administer the plan. Subject to the terms of the 2016 Omnibus Plan and applicable law, and the rules of the NASDAQ, the Committee (or its delegate) will have the power and authority to, among other things, designate participants and determine the types of awards to be granted, the number of shares to be covered and the terms and conditions of those awards. Additionally, the Committee has the authority to determine the vesting schedules of awards (which will generally provide for full vesting no earlier than 12 months from the date of grant, except with respect to an unrestricted pool of 5% of the total number of shares of Kraft Heinz common stock (“Common Shares”) available under the 2016 Omnibus Plan or certain other awards). The Committee will also have the authority to interpret and administer the 2016 Omnibus Plan and any instrument or agreement relating to the 2016 Omnibus Plan and to make any other determination and take any other action that it deems necessary or desirable for the administration of the 2016 Omnibus Plan.Shares available for awardsSubject to adjustment as provided below, the maximum number of shares available for issuance under the 2016 Omnibus Plan is 18,000,000 Common Shares. Each Common Share with respect to which an option or stock-settled SAR is granted will reduce the aggregate number of Common Shares available for issuance by one share, and each Common Share underlying any other stock-based awards granted under the 2016 Omnibus Plan will reduce the aggregate number of Common Shares available for issuance by one share. Following approval of the 2016 Omnibus Plan, Kraft Heinz will no longer make awards from legacy equity plans. With respect to SARs settled in shares, each Common Share with respect to which such SAR is exercised will count against the aggregate and individual share limitations, regardless of the number of shares actually delivered. If any option, SAR or other stock-based award granted under the plan expires, terminates or is canceled for any reason without having been exercised in full, the number of Common Shares subject to such award that were not issued will again be available for the purpose of awards under the 2016 Omnibus Plan. If any shares of restricted stock, performance awards or other stock-based awards denominated in shares awarded under the 2016 Omnibus Plan to a participant are forfeited for any reason, the number of forfeited shares of restricted stock, performance awards or other stock-based awards denominated in shares will again be available for purposes of awards under the 2016 Omnibus Plan. Common Shares tendered or withheld in payment of an exercise price or for withholding taxes of an award will not again be available for issuance under the 2016 Omnibus Plan.The following individual participant limitations will apply:(i)The maximum number of Common Shares subject to any award of stock options, SARs, restricted stock, RSUs or other stock-based award to a participant in any fiscal year will be 2,000,000 Common Shares per type of award or in the aggregate;(ii)There are no annual individual share limitations applicable to awards of restricted stock, RSUs or other stock-based awards for which the grant, vesting or payment is not subject to the attainment of performance goals;(iii)The maximum aggregate amount of cash that may be paid pursuant to performance awards which may be granted under the 2016 Omnibus Plan and are settled in cash based on the fair market value (as defined below in the section entitled “— Options”) of Common Shares to any participant in any fiscal year will be 2,000,000 Common Shares multiplied by the per-share fair market value as of the relevant vesting, payment or settlement date; and(iv)The maximum value of a cash payment made under a performance award (other than an award based on the fair market value (as defined below in the section entitled “— Options”) of Common Shares) which may be granted to any participant in any fiscal year will be $10,000,000.Additionally, the aggregate fair market value of awards that may be granted under the 2016 Omnibus Plan to a non-employee director for service as director during any fiscal year may not exceed $750,000.Eligible participantsAny director, employee, consultant or other service provider of Kraft Heinz or any of its subsidiaries will be eligible to participate in the 2016 Omnibus Plan. As of the date of this Proxy Statement, there are approximately 42,000 employees of Kraft Heinz and its subsidiaries and 11 non-employee directors of Kraft Heinz who are eligible to participate in the 2016 Omnibus Plan. However, only eligible employees of Kraft Heinz and its subsidiaries are eligible to be granted incentive stock options under the 2016 Omnibus Plan. Eligibility for the grant of awards and actual participation in the 2016 Omnibus Plan will be determined by the Committee in its sole discretion.Changes in capitalizationIn the event of any stock split, reverse stock split, stock dividend, extraordinary dividend, subdivision, combination or reclassification, reorganization or partial or complete liquidation, or any other corporate event having a similar effect, the Committee will appropriately adjust any or all of (i) the number and kind of shares that thereafter may be made the subject of awards under the plan (including the share limit, the incentive stock option limit and the annual individual share limits for performance-based awards) and (ii) the terms of any outstanding award, including the exercise price and the number or kind of shares or other securities of Kraft Heinz or other property subject to outstanding awards.In the event of a merger or consolidation that results in the acquisition of substantially all of the outstanding shares of Kraft Heinz, or in the event of a sale of substantially all of Kraft Heinz’s assets, the Committee may (i) make cash payment to award holders in exchange for the cancellation of the award (including, in the case of options and SARs, the excess of the fair market value (as defined in the 2016 Omnibus Plan) over the exercise price), (ii) cancel and terminate without payment any option or SAR having a per-share exercise price greater than or equal to the fair market value (as defined in the 2016 Omnibus Plan) of the shares subject to the award or (iii) provide for the substitution or assumption of awards, accelerate the exercisability or lapse of restrictions on awards, or deliver notice of termination at least five days prior to the consummation of such transaction, during which period participants may exercise outstanding awards.Description of AwardsOptionsSubject to the provisions of the 2016 Omnibus Plan, the Committee will be permitted to grant stock options under the 2016 Omnibus Plan. The exercise price per Common Share and terms of each option will be determined by the Committee; provided, however, that the exercise price will not be less than the fair market value of a Common Share on the date that the option is granted. Under the 2016 Omnibus Plan, the “fair market value” of a Common Share is equal to the closing price of a Common Share reported on the NASDAQ on the trading day of, or immediately prior to, the grant date. An option will be exercisable only in accordance with the terms and conditions established by the Committee in the award agreement. The 2016 Omnibus Plan prohibits repricing of stock options without stockholder approval. The Committee fixes the vesting terms it deems appropriate when granting options. In addition, the Committee may, in its discretion, provide that an option may become vested and exercisable in whole or in part, in installments, cumulative or otherwise, for any period of time specified by the Committee and reflected in an award agreement. Under our current form of option award agreement, options vest over a five year period and an optionee has 90 days to exercise his or her vested options after termination of employment without cause, and one year to exercise after retirement, death or disability. The Committee will fix the term of each option, not to exceed ten years.For non-U.S. participants, if the term of an option would otherwise expire during or within 10 business days of the expiration of a blackout period, the term of the option will be extended to the close of business of the tenth business day following the expiration of the blackout period.SARsSubject to the provisions of the 2016 Omnibus Plan, the Committee will be permitted to grant SARs under the 2016 Omnibus Plan. SARs may be granted to participants either alone (“freestanding”) or in addition to other awards granted under the 2016 Omnibus Plan (“tandem”). Except under certain circumstances described in the 2016 Omnibus Plan, a freestanding SAR will not have a term of greater than ten years. In the case of any tandem SAR related to an option, the SAR will not be exercisable until the related option is exercisable and will terminate, and no longer be exercisable, upon the termination or exercise of the related option. Unless it is a substitute award, a freestanding SAR will not have a grant price less than the fair market value (as defined above) of the Common Share on the date of grant.Restricted stock and RSUsSubject to the provisions of the 2016 Omnibus Plan, the Committee will be permitted to grant awards of restricted stock and RSUs under the 2016 Omnibus Plan. Shares of restricted stock and RSUs will be subject to any restrictions that the Committee may impose, including any limitation on the right to vote a share of restricted stock or the right to receive any dividend or dividend equivalent. If deemed necessary, the Committee may require that, as a condition of any grant of restricted stock, the participant will deliver a signed stock power or other instruments of assignment, which would permit transfer to Kraft Heinz of all or a portion of the Common Shares subject to the restricted stock award in the event that the award is forfeited.Deferred stockUnder the 2016 Omnibus Plan, the Committee is permitted to grant deferred stock to participants, subject to the conditions that deferred stock will be settled upon expiration of the deferral period specified for an award by the Committee. In addition, deferred stock will be subject to any restrictions on transferability, risk of forfeiture and other restrictions that the Committee may impose and, the Committee, in its discretion, may award dividend equivalents with respect to awards of deferred stock.Performance awardsThe Committee may grant a performance award to a participant payable upon the attainment of specific performance goals. The Committee may grant performance awards that are intended to qualify as “performance-based compensation” under Section 162(m), as well as performance awards that are not intended to qualify. If the performance award is an RSU or payable in shares of restricted stock, then the shares will be transferable to the participant or the RSU will vest only upon attainment of the relevant performance goal. The Committee will, in its sole discretion, designate within the first 90 days of a performance period (or, if shorter, within the maximum period allowed under Section 162(m) of the Code) the participants who will be eligible to receive performance compensation awards in respect of such performance period. The Committee will also determine the length of performance periods, the types of awards to be issued, the performance criteria that would be used to establish the performance goals, the kinds and levels of performance goals and any objective performance formula used to determine whether a performance compensation award has been earned for the performance period. The Committee is permitted to adjust or modify the calculation of performance goals in the event of any unusual or extraordinary corporate item, corporate transaction, any other unusual or nonrecurring events and changes in tax law or accounting standards, so long as that adjustment or modification does not cause the performance compensation award to fail to qualify as “performance-based compensation” under Section 162(m) of the Code.Investment rightsThe Committee is authorized to grant investment rights that entitle a participant to purchase for cash a stated number of Common Shares at a stated purchase price that is not less than the fair market value of Common Shares on the grant date. A participant will be entitled to exercise the right to purchase such Common Shares during the period specified in the investment rights notice. The Committee will determine the terms and conditions of such awards.Other awardsThe Committee is authorized to grant to participants other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, Common Shares or factors that may influence the value of Common Shares or an equity interest in any entity with respect to which, Kraft Heinz holds, directly or indirectly, a controlling interest. The Committee will determine the terms and conditions of such awards.The Committee is also permitted to grant cash-based awards to participants. In its discretion, the Committee will determine the number of cash-based awards to grant to a participant, the duration of the period during which, and any conditions under which, the cash incentive awards will be eligible to vest or will be forfeited, and any other terms and conditions applicable.Termination of EmploymentThe Committee may provide, by rule or regulation or in any award agreement, or may determine in any individual case, the circumstances in which awards shall be exercised, vested, paid or forfeited in the event a participant ceases to provide service to Kraft Heinz or any subsidiary prior to the end of a performance period or exercise or settlement of such award.Change in ControlUnless otherwise provided in an award agreement, in the event of a change in control (as defined in the 2016 Omnibus Plan), a participant’s unvested award will be treated in accordance with one of the following methods as determined by the Committee:(i)awards, whether or not vested, will be continued, assumed or have new rights substituted as determined by the Committee;(ii)the Committee, in its sole discretion, may provide for the purchase of any awards by Kraft Heinz or an affiliate for an amount of cash equal to the excess of the change in control price of the shares covered by such awards, over the aggregate exercise price of such awards; or(iii)if and to the extent that the approach chosen by the Committee results in an acceleration or potential acceleration of the exercise, vesting or settlement of an award, the Committee may impose such conditions upon the exercise, vesting or settlement of such award as it determines.Term of the 2016 Omnibus PlanNo award will be granted under the 2016 Omnibus Plan after ten years from the original effective date for the 2016 Omnibus Plan. However, unless otherwise expressly provided in the 2016 Omnibus Plan or in an award agreement, any award granted may extend beyond such date, and the authority of the Committee to amend, alter, adjust, suspend, discontinue, or terminate the award, or to waive any conditions or rights under the award, and the authority of the Board to amend the 2016 Omnibus Plan, will extend beyond such date.AssignabilityExcept as permitted by the Committee, awards granted under the 2016 Omnibus Plan may not be sold, pledged or otherwise transferred, other than following the death of a participant by will or thelaws of descent. A participant’s beneficiary or estate may exercise vested options during the applicable exercise period following the death of the participant, subject to the same conditions that would have applied to exercise by the participant.AmendmentThe Board may amend, suspend or terminate the 2016 Omnibus Plan and any outstanding awards granted under the 2016 Omnibus Plan, in whole or in part, at any time, provided that all material amendments to the 2016 Omnibus Plan require the prior approval of the stockholders and must comply with the rules of the NASDAQ. Examples of the types of amendments that the Board is entitled to make without stockholder approval include, without limitation, the following: (i) ensuring continuing compliance with applicable law, the rules of the NASDAQ or other applicable stock exchange rules and regulations or accounting or tax rules and regulations; (ii) minor changes of a “housekeeping” nature; (iii) changing the vesting provision of the 2016 Omnibus Plan or any award thereunder, subject to certain limitations; (iv) changing the termination provisions of any award that does not entail an extension beyond the original expiration date thereof; (v) adding a cashless exercise feature, payable in securities, where such feature provides for a full deduction of the number of underlying Common Shares from the 2016 Omnibus Plan reserve, and any amendment to a cashless exercise provision; (vi) adding a form of financial assistance and any amendment to a financial assistance provision which is adopted; (vii) changing the process by which a participant who wishes to exercise his or her award can do so; and (viii) delegating any and all of the powers of the Committee to administer the 2016 Omnibus Plan to officers of Kraft Heinz, subject to certain limitations.No amendment to the 2016 Omnibus Plan requiring the approval of the stockholders of Kraft Heinz under any applicable securities laws or requirements will become effective until such approval is obtained. In addition, the approval of the holders of a majority of the Common Shares present and voting in person or by proxy at a meeting of stockholders shall be required for, among other things, an increase in the maximum number of Common Shares that may be made the subject of awards under the 2016 Omnibus Plan, any adjustment (other than in connection with a stock dividend, recapitalization or other transaction where an adjustment is permitted or required under the 2016 Omnibus Plan), an amendment that reduces or would have the effect of reducing the exercise price of an option or SAR previously granted under the 2016 Omnibus Plan or an extension to the term or an outstanding option or SAR beyond the expiry date thereof. Furthermore, except as otherwise permitted under the 2016 Omnibus Plan, no change to an outstanding award that will adversely impair the rights of a participant may be made without the consent of the participant except to the extent that such change is required to comply with applicable law, stock exchange rules and regulations or accounting or tax rules and regulations.Section 162(m)Section 162(m) currently provides that if, in any year, the compensation that is paid to the Chief Executive Officer or to any of the three other most highly compensated executive officers (currently excluding the Chief Financial Officer) exceeds $1,000,000 per person, any amounts that exceed the $1,000,000 threshold will not be deductible by Kraft Heinz for U.S. federal income tax purposes, unless the compensation qualifies for an exception to Section 162(m). Certain performance-based awards under plans approved by stockholders are not subject to the deduction limit. Options and certain cash incentive awards to “covered employees” that will be awarded under the 2016 Omnibus Plan are intended to be eligible for this performance-based exception.Section 409ASection 409A of the Code imposes restrictions on nonqualified deferred compensation. Failure to satisfy these rules will result in accelerated taxation, an additional tax to the holder of the amount equal to 20% of the deferred amount, and a possible interest charge. Stock options granted with an exercise price that is not less than the fair market value of the underlying Common Shares on thedate of grant will not give rise to “deferred compensation” for this purpose unless they involve additional deferral features. Stock options that will be awarded under the 2016 Omnibus Plan are intended to be eligible for this exception. In addition, it is intended that the provisions of the 2016 Omnibus Plan comply with Section 409A of the Code, and all provisions of the 2016 Omnibus Plan will be construed and interpreted in a manner consistent with the requirements for avoiding taxes or penalties under these rules.U.S. Federal Income Tax ConsequencesThe United States federal income tax consequences of the issuance and/or exercise of option awards under the 2016 Omnibus Plan is as follows.Incentive stock optionsAn incentive stock option results in no taxable income to the optionee or a deduction to Kraft Heinz at the time it is granted or exercised. However, upon exercise, the excess of the fair market value of the Common Shares acquired over the option exercise price is an item of adjustment in computing the alternative minimum taxable income of the optionee, if applicable. If the optionee holds the Common Shares received as a result of an exercise of an incentive stock option for the later of two years from the date of the grant or one year from the date of exercise, then the gain realized on disposition of the Common Shares is treated as a long-term capital gain. If the Common Shares are disposed of during this period, however (i.e., a “disqualifying disposition”), then the optionee will include into income, as compensation for the year of the disposition, an amount equal to the excess, if any, of the fair market value of the Common Shares, upon exercise of the option over the option exercise price (or, if less, the excess of the amount realized upon disposition of the Common Shares over the option exercise price). Any additional gain or loss recognized upon the disposition will be recognized as a capital gain or loss by the optionee. In the event of a disqualifying disposition, Kraft Heinz will be entitled to a deduction, in the year of such a disposition, in an amount equal to the amount includible in the optionee’s income as compensation. The optionee’s tax basis in the Common Shares acquired upon exercise of an incentive stock option is equal to the option price paid, plus any amount includible in his or her income as a result of a disqualifying disposition.Non-qualified stock optionsA non-qualified stock option results in no taxable income to the optionee or deduction to Kraft Heinz at the time it is granted. An optionee exercising a non-qualified stock option will, at that time, realize taxable compensation in the amount equal to the excess of the then fair market value of the Common Shares over the option exercise price. Subject to the applicable provisions of the Code, Kraft Heinz will be entitled to a deduction for federal income tax purposes in the year of exercise in an amount equal to the taxable compensation realized by the optionee. The optionee’s tax basis in Common Shares received upon exercise is equal to the sum of the option exercise price plus the amount includible in his or her income as compensation upon exercise.Any gain (or loss) upon subsequent disposition of the Common Shares will be a long or short-term capital gain to the optionee (or loss), depending upon the holding period of the Common Shares. If a non-qualified option is exercised by tendering previously owned Common Shares in payment of the option price, then, instead of the treatment described above, the following will apply: a number of new Common Shares equal to the number of previously owned shares tendered will be considered to have been received in a tax-free exchange; the optionee’s basis and holding period for such number of new Common Shares will be equal to the basis and holding period of the previously owned Common Shares exchanged. The optionee will have compensation income equal to the fair market value on the date of exercise of the number of new Common Shares received in excess of such number of exchanged Common Shares; the optionee’s basis in such excess Common Shares will be equal to the amount of such compensation income, and the holding period in such Common Shares will begin on the date of exercise.Plan BenefitsIt is not presently possible to determine the dollar value of payments that may be made or the number of awards that may be granted under the 2016 Omnibus Plan in the future, or the individuals who may be selected for such awards because awards under the 2016 Omnibus Plan are made at the discretion of the Compensation Committee.The Board recommends a vote FOR the approval of The Kraft Heinz Company 2016 Omnibus Incentive Plan.PROPOSAL 5. RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORSselection,appointment, compensation, oversight, retention and termination of our independent auditors. Pursuant to its Charter, the Audit Committee has authority to approve all audit engagement fees to be paid to the independent auditors. The Audit Committee selected PricewaterhouseCoopers LLP (“PwC”),PwC, a registered public accounting firm, as our independent auditors for 2016. 2017.20142015 and 2015,2016, can be found below under “Board Committees and Membership — Audit Committee.”2016.One PPG Place, Pittsburgh, Pennsylvania 15222.200 East Randolph Street, Suite 7600, Chicago, IL 60601.•Leadership Structure. We have an independent Chairman of the Board, separate from our Chief Executive Officer. No member of our management serves on the Board.•Executive Sessions. At each Board meeting, our directors meet without the Chief Executive Officer or any other members of management present to discuss issues important to Kraft Heinz, including any matters regarding management.•Special Meetings of the Board. Our Amended and Restated By-Laws (the “By-Laws”) allow the Chairman, the Vice Chairman, along with two other directors, or the majority of the directors then in office to call special meetings of the Board.•Annual Performance Evaluation. The Governance Committee develops and oversees an annual evaluation process for the Board.•Special Meetings of Stockholders. Our By-Laws allow stockholders of record of at least 20% of the voting power of our outstanding stock to call a special meeting of stockholders.•Stockholder Action by Written Consent. Our Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) allows stockholder action by written consent if such consent is signed by stockholders holding not less than the minimum number of shares necessary to authorize such action at a meeting at which all shares of capital stock entitled to vote thereon were present and voted.•Majority Voting in Director Elections. Our By-Laws provide that in uncontested elections, director nominees must be elected by a majority of the votes cast.directorsdirector nominees are independent: Mr. Abel, Mr. Behring, Mr. Buffett, Ms. Britt Cool, Mr. Cox,Dewan, Ms. Jackson, Mr. Lemann, Mr. McDonald, Mr. Pope and Mr. Telles. Mr. Cox, who retired in April 2016, was also determined to be independent. Mr. Cahill, the former Chief Executive Officer of Kraft and a current consultant to Kraft Heinz, is not independent.agreeagrees that for so long as Berkshire Hathaway and its affiliates control shares representing at least 66% of the voting power in election of directors of shares owned by Berkshire Hathaway as of the consummation of the merger, 3G Global Food Holdings and its affiliates will vote their shares of Kraft Heinz common stock in favor of the three Kraft Heinz board nominees designated by Berkshire Hathaway and not take any action to remove such designees without Berkshire Hathaway’s consent. Similarly, Berkshire Hathaway will agree that for so long as 3G Global Food Holdings and its affiliates control shares representing at least 66% of the voting power in elections of directors of shares owned by 3G Global Food Holdings as of the consummation of the merger, Berkshire Hathaway and its affiliates will vote their shares of Kraft Heinz common stock in favor of the three Kraft Heinz board nominees designated by 3G Global Food Holdings and not take any action to remove such designees without 3G Global Food Holdings’ consent. The shareholders’ agreement provides that each party’s foregoing rights and obligations will step down upon specified reductions in ownership below the 66% threshold described above by either 3G Global Food Holdings or Berkshire Hathaway and their respective affiliates, as applicable.2015,2016, Mr. Cahill received $2,000,000$4,000,000 as payment for his services under this agreement.January 3,December 31, 2016, all required filings were timely made in accordance with Exchange Act requirements, except four. In July 2015, we were late in filing the Form 3 of Eduardo Pelleissone, our Executive Vice President of Global Operations, to report his initial stock ownership in connection with the 2015 Merger. In November 2015, we filed a Form 4 on Jeanne Jackson’s behalf reporting an inadvertent purchase and subsequent sale of shares by her broker without her knowledge or direction. Upon discovering the error, we filed a Form 4 on Ms. Jackson’s behalf to report the transactions. In February 2016, we filed a Form 5 to report additional shares of common stock inadvertently omitted from the Form 3 filed on behalf of Matthew Hill, our Zone President of Europe, reporting his initial stock ownership in connection with the 2015 Merger. In March 2016, we filed a Form 4 on behalf of George Zoghbi, our Chief Operating Officer of the U.S. Commercial business, relating to the late reporting of the tax withholding in connection with the vesting of certain stock awards.isare available on our Web site at http://ir.kraftheinzcompany.com/governance.cfm.governance.cfm. Our Corporate Secretary forwards communications relating to matters within the Board’s purview to the independent directors; communications relating to matters within a Board committee’s area of responsibility to the chair of the appropriate committee; and communications relating to ordinary business matters, such as suggestions, inquiries and consumer complaints, to the appropriate Kraft Heinz executive or employee. Our Corporate Secretary does not forward solicitations, junk mail and obviously frivolous or inappropriate communications.serve and annual meetings.serve. We understand, however, that occasionally a director may be unable to attend a meeting. The Board held sixfive meetings in 20152016 and the committees of the Board held a total of 1219 meetings. Each director attended 75% or more of the aggregate of all meetings of the Board and the committees on which he or she served during 2015. As we were2016. Directors are invited, but are not a public company until afterrequired, to attend the 2015 Merger, we did not hold an annual meetingAnnual Meeting of stockholdersStockholders. At our 2016 Annual Meeting of Stockholders, three of our directors attended in 2015.Following the 2015 Merger, theThe Board hadhas four standing committees: Audit, Compensation, Governance and Operations and Strategy. The Board has a written charter for each committee. The charters setcommittee, which sets forth each committee’s roles and responsibilities. All committeeThese charters are available on our Web site as discussed above under “Corporate Governance and Board Matters —Governance Guidelines and Codes of Conduct — Corporate Governance Materials Available on Our Web site.” The following table lists the current committee membership and the number of meetings held by each committee in 2015. Audit Compensation Governance Operations

& Strategy Chair Chair X Chair X X X X X X X X X Chair X X X 5 2 1 2 *Mr. Cox’s term on the Board will expire at the Annual Meeting.Director Audit Compensation Governance Alexandre Behring (Chairman) Chair Chair X John T. Cahill (Vice Chairman) Chair Gregory E. Abel X Tracy Britt Cool Warren E. Buffett Feroz Dewan X Jeanne P. Jackson X X Jorge Paulo Lemann X X Mackey J. McDonald X X John C. Pope Chair X Marcel Herrmann Telles X X Meetings in 2016 11 2 4 2 partner.20152016 from us other than compensation for service as a director.www.KraftHeinzEthics.com.www.KraftHeinzEthics.com.Audit Committee Report for the Year Ended January 3, 2016To our Stockholders:Management has primary responsibility for Kraft Heinz’s financial statements and the reporting process, including the systems of internal control over financial reporting. The role of the Audit Committee of the Kraft Heinz Board of Directors is to oversee Kraft Heinz’s accounting and financial reporting processes and audits of its financial statements. In addition, we assist the Board in its oversight of:The integrity of Kraft Heinz’s financial statements and Kraft Heinz’s accounting and financial reporting processes and systems of internal control over financial reporting and safeguarding the company’s assets;Kraft Heinz’s independent auditors’ qualifications, independence and performance;The performance of Kraft Heinz’s internal auditors and the internal audit function;Kraft Heinz’s financial matters and financial strategy; andKraft Heinz’s guidelines and policies with respect to risk assessment and risk management.Our duties include overseeing Kraft Heinz’s management, the internal audit department and the independent auditors in their performance of the following functions, for which they are responsible:ManagementPreparing Kraft Heinz’s consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP);Establishing and assessing effective financial reporting systems and internal controls and procedures; andReporting on the effectiveness of Kraft Heinz’s internal control over financial reporting.Internal Audit DepartmentIndependently assessing management’s system of internal controls and procedures; andReporting on the effectiveness of that system.Independent AuditorsAuditing Kraft Heinz’s financial statements;Issuing an opinion about whether the financial statements conform with U.S. GAAP; andAuditing the effectiveness of Kraft Heinz’s internal control over financial reporting.Periodically, we meet, both independently and collectively, with management, the internal auditors and the independent auditors, among other things, to:Discuss the quality of Kraft Heinz’s accounting and financial reporting processes and the adequacy and effectiveness of its internal controls and procedures;Review significant audit findings prepared by each of the independent auditors and internal audit department, together with management’s responses; andReview the overall scope and plans for the current audits by the internal audit department and the independent auditors.Prior to Kraft Heinz’s filing of its Annual Report on Form 10-K for the year ended January 3, 2016, with the SEC, we also:Discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380);Discussed with the independent auditors their evaluation of the accounting principles, practices and judgments applied by management;Discussed all other items the independent auditors are required to communicate to the Audit Committee in accordance with applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee concerning independence;Received from the independent auditors the written disclosures and the letter describing any relationships with Kraft Heinz that may bear on the independent auditors’ independence; andDiscussed with the independent auditors their independence from Kraft Heinz, including reviewing non-audit services and fees to assure compliance with (i) regulations prohibiting the independent auditors from performing specified services that could impair their independence and (ii) Kraft Heinz’s and the Audit Committee’s policies.Based upon the reports and discussions described in this report and without other independent verification, and subject to the limitations of our role and responsibilities outlined in this report and in our written charter, we recommended to the Board, and the Board approved, that the audited consolidated financial statements be included in Kraft Heinz’s Annual Report on Form 10-K for the year ended January 3, 2016, which was filed with the SEC on March 3, 2016.Audit Committee:John C. Pope, ChairL. Kevin CoxJeanne P. JacksonMackey J. McDonald2015,2016, the Audit Committee pre-approved all audit and non-audit services provided by the independent auditors.20152016 and 20142015 are set forth in the table below (in thousands). 2015 2014 $ 11,842 $ 5,809 879 196 2,679 794 — — $ 15,400 $ 6,799 2016 2015 Audit Fees $ 8,079 $ 11,842 Audit-Related Fees 134 879 Tax Fees 676 2,679 All Other Fees 15 — Total $ 8,904 $ 15,400 “2017“2018 Annual Meeting of Stockholders” in this Proxy Statement.20152016 are independent within the meaning of the NASDAQ listing standards. No member of the Compensation Committee is a current, or during 20152016 was a former, officer or employee of Heinz, Kraft, Kraft Heinz or any of its subsidiaries. During 2015,2016, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related person transactions (for a description of our policy on related person transactions, see “Corporate Governance and Board Matters — Independence and Related Person Transactions” in this Proxy Statement). During 2015,2016, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee.programs, including our severance programs and executive retirement income design;programs;overseeingin consultation with the Chief Executive Officer, periodically reviewing the company’s management development and succession planning process (including succession planning for emergencies) for our Chief Executive Officer and his executive direct reports and, as appropriate, evaluating potential candidates;monitoring our policies, objectives and programs related to diversity and inclusion and reviewing periodically our performance in light of appropriate measures; current risk profile of our executive and broad-based employee compensation programs. In its 20152016 evaluation, the Compensation Committee reviewed our executive compensation structure to determine whether our compensation policies and practices encourage our executive officers or employees to take unnecessary or excessive risks and whether these policies and practices properly mitigate risk. As described below under “Compensation Discussion and Analysis,” our compensation structure is designed to incentivize executives and employees to achieve company financial and strategic goals as well as individual performance goals that promote long-term stockholder returns. Based on its assessment of the current programs, the Compensation Committee concluded that the 20152016 executive compensation plans were designed in a manner to:Compensation Committee Report for the Year Ended January 3, 2016The Compensation Committee oversees our compensation programs on behalf of the Board. In fulfilling its oversight responsibilities, the Compensation Committee reviewed and discussed with management the Compensation Discussion and Analysis included in this Proxy Statement. In reliance on that review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in our Proxy Statement to be filed with the SEC in connection with our Annual Meeting and incorporated by reference in our Annual Report on Form 10-K for the year ended January 3, 2016, which was filed with the SEC on March 3, 2016.Compensation Committee:Alexandre Behring, ChairL. Kevin CoxJorge Paulo LemannMackey J. McDonaldMarcel Herrmann Telles

our corporate strategy, integration plans, performance, and annual capital plan, as well as certain individual capital projects; the impact of external developments and factors, such as the changes in economic and market conditions, competition in the industry, environmental and safety regulations, federal, state and local regulations and technology, on our corporate strategy and its execution; identification of prospects and opportunities for corporate developments and growth initiatives, including acquisitions, divestitures, joint ventures and strategic alliances; and implementation of our corporate strategy through corporate developments and growth initiatives, including acquisitions, divestitures, joint ventures and strategic alliances.

Prior to the 2015 Merger, non-employee directors of Heinz received an annual retainer of $50,000, paid in arrears on December 31 of each year. The Chairman received an annual retainer of $100,000. We also paid directors an additional $10,000 if they served on a Board committee. In lieu of a cash retainer payment, all directors could elect to receive two times the value of their retainer in RSUs. The RSUs were vested as of the grant date, but were not distributed until the date the director ceases to serve on the Board. All directors of Heinz elected to receive RSUs other than Mr. Buffett, who chose to receive no compensation.

Compensation Element(1) | Fee ($) | ||||

Board Retainer | 110,000 | ||||

Chairman Retainer | 250,000 | ||||

Audit Committee Chair Retainer | 20,000 | ||||

Compensation Committee Chair Retainer | 20,000 | ||||

Governance Committee Chair Retainer | 10,000 | ||||

Operations and Strategy Chair Retainer | 20,000 | ||||

Stock Grant Value(2) | 125,000 | ||||

| (1) | If a director serves as Chair of multiple committees, he/she receives fees for only one committee. Therefore, Mr. Behring does not receive a retainer for service as Chair of the Governance Committee. | |

| (2) | ||

We pay the non-employee director cash retainers quarterly.

Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2)(3) ($) | All Other Compensation ($) | Total ($) | ||||||||||||

Gregory E. Abel | 54,402 | 182,118 | — | 236,520 | ||||||||||||

Alexandre Behring | 133,533 | 301,881 | — | 435,414 | ||||||||||||

John T. Cahill(4) | 64,293 | — | — | 64,293 | ||||||||||||

Tracy Britt Cool | 54,402 | 206,129 | — | 260,531 | ||||||||||||

L. Kevin Cox | 54,402 | — | — | 54,402 | ||||||||||||

Jeanne P. Jackson | 54,402 | — | — | 54,402 | ||||||||||||

Jorge Paulo Lemann | 54,402 | 182,118 | — | 236,520 | ||||||||||||

Mackey J. McDonald | 54,402 | — | — | 54,402 | ||||||||||||

John C. Pope | 64,293 | — | — | 64,293 | ||||||||||||

Marcel Herrmann Telles | 54,402 | 182,118 | — | 236,520 | ||||||||||||

| Name | Fees Earned or Paid in Cash (1) ($) | Stock Awards(2) ($) | All Other Compensation ($) | Total ($) | ||||||||

| Gregory E. Abel | 110,000 | 125,009 | — | 235,009 | ||||||||

| Alexandre Behring | 270,000 | 125,009 | — | 395,009 | ||||||||

John T. Cahill(3) | 130,000 | 125,009 | — | 255,009 | ||||||||

| Tracy Britt Cool | 110,000 | 125,009 | — | 235,009 | ||||||||

| L.Kevin Cox | 33,846 | — | — | 33,846 | ||||||||

| Feroz Dewan | 21,522 | 62,335 | — | 83,857 | ||||||||

| Jeanne P. Jackson | 110,000 | 125,009 | — | 235,009 | ||||||||

| Jorge Paulo Lemann | 110,000 | 125,009 | — | 235,009 | ||||||||

| Mackey J. McDonald | 110,000 | 125,009 | — | 235,009 | ||||||||

| John C. Pope | 130,000 | 125,009 | — | 255,009 | ||||||||

| Marcel Herrmann Telles | 110,000 | 125,009 | — | 235,009 | ||||||||

| (1) | Includes all retainer fees paid or deferred pursuant to the Kraft Heinz Deferred Compensation Plan for Non-Management Directors. | |

| The amounts shown in this column represent the full grant date fair value of the | 2016: |

Name | Unvested Stock Options(a) | |||

| Gregory E. Abel | 22,166 | |||

Alexandre Behring | 44,333 | |||

| ||||

Tracy Britt Cool | 22,166 | |||

| ||||

| ||||

Jorge Paulo Lemann | 22,166 | |||

| ||||

| ||||

Marcel Herrmann Telles | 22,166 | |||

| (a) | Upon commencing service as a director of Heinz in 2013, each non-employee director received a one-time stock option grant equal to $500,000 ($1,000,000 for the Chairman). These options were granted on October 16, 2013 with an exercise price of $22.56. The options cliff-vest on July 1, 2018 and are subject to pro rata vesting in certain circumstances. | ||

| (3) | ||

| ||

| Name | Title | |

| Bernardo Hees | Chief Executive Officer | |

Paulo Basilio | Executive Vice President and Chief Financial Officer | |

Eduardo Pelleissone | Executive Vice President, Global Operations | |

| Zone President of | |

| ||

Explanatory Note

On July 2, 2015, through a series of transactions, we consummated the merger (the “2015 Merger”) of Kraft Foods Group, Inc. (“Kraft”) with and into H.J. Heinz Company, a wholly owned subsidiary of H.J. Heinz Holding Corporation (“Heinz”). At the closing of the 2015 Merger, Heinz was renamed

Prior to the 2015 Merger, the Heinz board of directors had not historically designated a compensation committee. Instead, the full Heinz board of directors was integrally involved in the design of Heinz’s compensation program and decisions with respect to executive compensation. Effective with the closing of the 2015 Merger, the Compensation Committee of the Board of Directors, referred to in this CD&A as the “Committee,” assumed primary responsibility for the design of the compensation program for Kraft Heinz and decisions with respect to executive compensation.

Executive Summary

The Committee(the “Committee”) oversees our executive compensation plans and programs. Our programs are designed to complement each other to provide a clear link between what we pay our NEOs and Kraft Heinz’s performance over both short- and long-term periods. The overall program has been designed to accomplish each of the following goals:

Rewarding superior financial and operational performance;

Placing a significant portion of compensation at risk if performance goals are not achieved;

Aligning the interests of the NEOs with those of our stockholders; and

Enabling us to attract, retain and motivate top talent.

As

performancepay-for-performance philosophy and meritocratic principles. The following table summarizes the primary elements and objectives of our 20152016 compensation program for executive officers, including NEOs.

|

| |||

| Element | Description | Primary Objectives | ||

| Base Salary | Ongoing cash compensation based on the executive officer’s role and responsibilities, individual job performance and experience. | • Recruitment and retention | ||

| Annual Cash Incentive (Performance Bonus Plan) | Annual incentive with target award amounts for each executive officer. Actual cash payouts are linked to achievement of annual company goals and individual performance and can range from 0%-130% of target. | • • Motivate and reward | ||